Soon after moving into a new home in San Francisco's Marina District, Dan Clarke began stumbling across what he thought were peculiar black rocks in his yard.

Clarke, who bought the house in 2000 after retiring, described the rocks as crumbly and fragile, ranging from peanut-sized to some that were larger than a softball. He didn't know what they were until a decade later, when he and several neighbors received a letter from their utility company, Pacific Gas & Electric (PG&E), he told Utility Dive.

The letter informed them that their properties were located around the sites of what used to be manufactured gas plants (MGPs) — historic facilities that more than a century ago produced gas for homes and businesses and, in many cases, according to experts, left behind residues from their operations. Regulators and toxicologists did not believe the sites posed a health concern, PG&E wrote, but the utility was conducting a program to survey these properties and confirm that belief.

After receiving the letter, Clarke brought the utility a shoebox full of the black rocks he'd been finding in his backyard. PG&E tested the rocks and informed him that they contained chemicals well in excess of concentrations designated as hazardous by the Environmental Protection Agency, and they appeared to be a product of the old MGP, he said.

"So at that point, we had confirmed contamination on the property — and literally on the surface of the yard," Clarke said.

The former MGP site whose footprint Clarke's home is located on is one of 42 plants identified as having been owned or operated by PG&E, and the utility is not unique in this regard. Thousands of MGPs dotted the U.S. landscape in the 19th century, producing gas that was used for heating, lighting and cooking.

"There were companies that got out in front of the problem and dealt with [it] immediately, and others that kind of hung back. So there's plenty of MGP work yet to be done."

James Cummings

Program Analyst, U.S. Environmental Protection Agency

Today's utilities have inherited many of these sites along with the responsibilities for addressing the wastes the plants left behind, which regulators say contain known or suspected carcinogens and other hazardous chemicals. Several utilities have made substantial progress on addressing the issue, experts say. But thanks to a variety of factors — including the complicated remediation processes involved, access issues and in some cases, lack of knowledge — utilities and other parties with MGP liabilities still face a significant amount of technically and logistically challenging work, at substantial cost, they note.

"There were companies that got out in front of the problem and dealt with [it] immediately, and others that kind of hung back. So there's plenty of MGP work yet to be done," James Cummings, a program analyst with the U.S. Environmental Protection Agency (EPA), said.

The beginning — and end — of MGPs

Manufactured gas production was common all around the country until the mid-20th century. There was a time when no self-respecting community in the U.S. was without its own MGP, according to Cummings.

The EPA estimated in a 1999 report that 3,000 to 5,000 former MGP sites exist around the country — some still owned by the successors of the utility companies that operated them.

In general, the plants worked by heating some kind of organic feedstock — typically coal, oil or wood — in closed containers called retorts, "cracking" their hydrocarbon chains and releasing combustible gas. The technology was imported into the U.S. from Britain, and Baltimore began using it to generate gas to light its homes and streets in 1816, according to Allen Hatheway, a geological engineer and author of two technical books on the remediation of former MGPs. The plants quickly began spreading to other parts of the East Coast "as fast as people could gather the money to construct a plant and then to lay the piping underground," Hatheway added. Soon, MGP technology spread across the country.

Pacific Gas & Electric's former Salinas, California MGP in 1929

Permission granted by PG&E

But the use of MGPs began to dwindle in the first half of the 20th century, as the energy industry began to pivot instead toward natural gas — a fuel that was seen as more convenient and better quality than manufactured gas, which required what amounted to a heavily staffed, complicated industrial process and large amounts of real estate to produce. According to Hatheway, these last gas plants run by towns stopped operating by 1966, although some industrial fuel plants operated gas producers as late as the 1990s.

The plants were largely demolished, and today, experts say, some sites have been redeveloped into an assortment of establishments: residential neighborhoods, an oil terminal, a garage for municipal buses and so on. Many of the MGPs were originally built on the fringes of cities, but those sites are now in inner-city areas, as the urban landscape around them grew. In some cases, they span several blocks.

In Massachusetts, for instance, low-income housing was built over an old MGP waste dump site, said Tom Speight, a state regulator with 17 years of previous environmental consulting experience. Speight co-authored a book on the history and remediation of MGPs with Hatheway. The MGP that used to be located around Clarke's property in San Francisco was shut down after it was damaged in the 1906 earthquake that rocked San Francisco; the city later acquired the site and it was then developed into residential and commercial spaces.

But the plants left behind traces of gas production byproducts — tars, sludges, oils and lampblack, for instance — which, according to the EPA, could contain polycyclic aromatic hydrocarbons, petroleum hydrocarbons, benzene and cyanide. In the instance of the low-income housing project in Massachusetts, for example, Speight recalls how a couple of heavy storms eroded the topsoil, exposing dirt that had been stained blue by old MGP materials. Similarly, black rocks like the kind that Clarke found in his yard are relics of the operation of the old gasworks.

Today, due to approximately 150 years of corporate mergers, many U.S. utilities are on the hook for cleaning up those products, Speight explained. This is because the local gas light companies that originally operated the MGPs have, over the course of time, merged or been bought out by larger corporations or utility holding companies, he added. When environmental regulators became aware that some of the sites still held contaminants, responsibility for remediating many of them fell to the corporate successors of those companies — whether or not they currently own the property where the plant operated.

PG&E, for instance, created a voluntary program — overseen by the California Department of Toxic Substances Control — to identify and test MGP sites after EPA research in the 1980s indicated that they might still contain MGP byproducts.

'It's a mature field'

Remediating a former MGP site can be a complicated process that varies drastically from site to site. For sites listed on the EPA's National Priorities List, the agency tries to identify the parties that are responsible for the contamination at the site and either negotiates with them or orders them to complete or pay for the cleanup work. This work follows a structured process, which includes a remedial investigation to characterize the contamination, evaluate potential remedies, select strategies that will then be available for public comment, and then implement them. Sites that are not on the National Priorities List may be tackled under state cleanup programs, according to the EPA.

It's tough to pinpoint exactly how much of the remediation work utilities across the nation have completed, in part because it can be a moving target. Speight estimates that one-third to one-half of sites that housed gasworks across the country have not completed remediation, either because of the degree of difficulty or because utilities and regulators don't yet know about them.

In addition, he noted, many of these plants also had off-site dumps where operators disposed of their waste, and the locations of those dumps aren't always recorded in historical literature. Once those are taken into account, the amount of unfinished work may be much greater.

"It's a mature field, and so that's why the research is no longer being funded. [Utilities] have got the tools and technologies they need, now it's just a matter of wrapping up implementation."

Bruce Hensel

Technical Executive, Electric Power Research Institute

A lot of MGP remediation activity happened in the 1990s, 2000s and even into the 2010s, according to experts at the Electric Power Research Institute. At this point, it's fair to assume that the industry is aware of where the problems are and is in the process of remediating and managing them, according to Bruce Hensel, technical executive with EPRI.

The organization hasn't surveyed the industry to determine the status of the cleanups, but in general, "the easy sites are done," explained Lea Millet, senior technical leader with the institute.

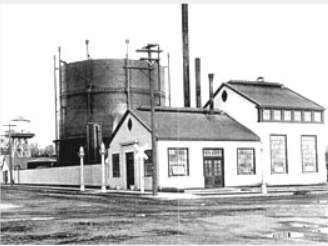

Pacific Gas & Electric's former MGP in Chico, California, around 1920

Permission granted by PG&E

"It's a mature field, and so that's why the research is no longer being funded. [Utilities] have got the tools and technologies they need, now it's just a matter of wrapping up implementation," added Hensel.

In some ways, it appears the industry has "peaked" in terms of cleaning up former MGP sites, Cummings said, and the work seems to have diminished. In part, he said, that can be attributed to the belief that most of the research has been done, and existing remedies are suitable. But he also attributes it to other, newer problems that the utility sector is grappling with.

"Many utilities… have these huge impoundments of coal combustion ash, and because of the headlong rush to renewables, many of the power plants are being decommissioned. So decommissioning and coal combustion residuals are newer problems that, to some extent, are crowding out the interest or focus on MGP sites," he said.

The utility sector has not been able to close the book completely on MGP remediation for multiple reasons, according to Speight. First, it's just intrinsically difficult work that takes a while to figure out.

"You're dealing with some substances that are heavier than water, so they go down through the soil, down into the water table, down through the water table, land up on top of the bedrock surface … and they just slide along like rain on top of a roof," he said.

Second, MGP remediation can only take place once the sites are identified. While most of the large gasworks have been discovered, utilities may not be aware of large offsite dumps or satellite facilities that may come to light at some point in the future, according to Speight.

In addition, MGP records don't always capture when a utility shut down one old MGP just to open up another one — something that utilities didn't necessarily understand in the late 1980s and early 1990s, when they were reporting to regulators the sites they thought they had in their inventory.

"So some of them have potentially a few gasworks out there that they're potentially liable for — but they don't know about it yet," Speight said.

For some utilities, like Consolidated Edison Co. (ConEd) and PG&E, the fact that MGP sites are often owned by other parties can present challenges as well. ConEd, for instance, needs to work in a dense, urban setting and navigate separate access agreements with multiple property owners, utility spokesperson Allan Drury said in an email.

Liability: An intricate and complicated issue

The cost of the cleanup work remaining to be done, as well as the potential liabilities that MGPs pose to utilities, is probably in the billions of dollars across the country, according to Speight.

Remediating a single property can cost utilities anywhere from $2 million for smaller sites to $30 million or $40 million for larger ones, or even over $100 million if major dredging is necessary, he said. Depending on what different states' regulatory frameworks require, some former gasworks sites could stay in a phase of "managed stewardship," or "operation and maintenance," where the utility monitors the property but isn't yet undertaking intensive remedy work.

Sometimes, however, this strategy could end up being more expensive over the long term: At a certain point, Speight said, it becomes cheaper to clean up the property and potentially sell it rather than sit on it for two decades while paying taxes, regulatory fees, monitoring the groundwater, and completing all of the other responsibilities that may be required for a site in a regulatory program.

Pacific Gas & Electric's former North Beach MGP in San Francisco

Permission granted by PG&E

Sitting on an MGP site for a while could also open up utilities to lawsuits. If contamination extends under a neighboring property, for instance, a utility could be exposed to litigation and the associated costs — even if that contamination happened 150 years ago. And in some cases, a property owner could demand that the utility purchase the nearby contaminated site, he said.

"The costs for that can be significantly greater than the cost of just doing the cleanup work, because lawyers are more expensive than engineers per hour," Speight said.

In 2014, Clarke, along with the San Francisco Herring Association, filed a lawsuit against PG&E related to the contamination its old MGPs caused in San Francisco.

The suit alleged that the soil and groundwater around the old MGPs were contaminated with wastes that contained levels of polycyclic aromatic hydrocarbons that were highly toxic to humans and other animals, and that those residues presented an "imminent and substantial endangerment to human health and the environment." It also criticized PG&E for being reluctant to conduct tests to determine the full extent of the contamination under homes, gardens, groundwater and the San Francisco Bay itself.

Two years later, the utility ended up purchasing Clarke's home as part of a settlement agreement. In 2020, Clarke filed another lawsuit, which is still ongoing, against the utility. This one concerns another MGP that used to exist near San Francisco's Fisherman's Wharf.

"I think it's a legacy liability that can be managed effectively over time with reasonable oversight — and, hopefully, regulatory support, recognizing that these assets were acquired in the ordinary course of an important public service business many years ago."

Stephen Humes

Partner, Holland & Knight

When it comes to the cost of remediating MGP sites, most states do allow some degree of those costs to be passed to ratepayers, according to Speight.

One complication with MGP-related liabilities is that they can change as regulations change, Speight noted in an email. For instance, around a decade ago, New Jersey revamped its environmental regulations, effectively drawing in a larger population of contaminated sites and making the technical requirements for remediating them more stringent.

And as the industry's understanding of how contaminants can migrate in soil and groundwater improves, it isn't unusual for new assessments to find issues that those carried out in the 1980s and 1990s missed, he added.

But while liability can be a major driver for remediation work, it's an intricate and complicated issue, and different utilities make different calculations in terms of the risks and benefits of cleaning up a site.

"I think it's a legacy liability that can be managed effectively over time with reasonable oversight — and, hopefully, regulatory support, recognizing that these assets were acquired in the ordinary course of an important public service business many years ago," said Stephen Humes, a partner with Holland & Knight, who has assisted clients with MGP sites in their portfolios.

In some cases, said Humes, a utility might hold on to a site for future use or development. In that context, "'how clean is clean' is a function of what your future intended use is," he said. If someone wanted to build a school or residential housing complex on the site, it would likely require a huge cleanup operation. But, as an example, if someone planned to use the area to stage materials for assembling offshore wind turbines, "you could reuse that site with little cleanup costs, and that’s a scenario where a utility might have some interest in working with a future developer to come up with an economic use for that property."

Humes is uncertain about the magnitude of utility MGP liabilities around the country. But it isn’t common in 2021 for utilities to be declaring that they are taking a material hit resulting from MGP liability, he said.

"I think this is a risk that the utilities have been aware of for decades. They have been managing it, and if there’s going to be a reuse, the reuse is going to have to take into consideration addressing the cleanup," he added.

While utilities do include an estimate of MGP liabilities in their SEC filings, it can be difficult for them to pin down the exact cost as well. In some cases, said Bill Thompson, senior technical advisor with NorthWestern Energy, the utility doesn't have enough information and an actual remediation plan yet.

'There's a ton of contamination still there'

In some cases, utilities still face criticism for their handling of MGP sites. Clarke, for instance, does not think PG&E and regulators have done enough to clean up the area around the San Francisco MGPs.

"There's a ton of contamination still there," he said.

While he doesn't think residents of the area need to "run for the hills," he believes more awareness should be spread about the issue.

"People should know about this and then decide, each of them for themselves, what precautions, what level of risk they are willing to take — or not willing to take," Clarke said.

When asked about these frustrations and the possible long-term liabilities utilities could face on this front, Danielle Starring, director of remediation at PG&E, said that PG&E isn't the only party responsible for the broader MGP issue and that the city of San Francisco also has a role to play.

"I don't want to speculate that there isn't contamination around. I don't think that there's a widespread PG&E liability around. I think we're doing our part, we continue to do our part, and it's voluntary," she said.

Utility Dive reached out to three utilities to get a better understanding of their MGP cleanup efforts, the challenges they face and the lessons they've learned in the process. Here's what they had to say:

"later" - Google News

October 11, 2021 at 10:19PM

https://ift.tt/3mFpQtD

A century later, utilities still face billions in potential liabilities from obsolete manufactured gas plants - Utility Dive

"later" - Google News

https://ift.tt/2KR2wq4

Bagikan Berita Ini

0 Response to "A century later, utilities still face billions in potential liabilities from obsolete manufactured gas plants - Utility Dive"

Post a Comment